2021 colorado ev tax credit

Conversion to a clean fuel refrigerated trailer. To make the plan work the states largest power company has also tailored the new.

How Do Electric Car Tax Credits Work Credit Karma

FDR 0617 071321 COLORADO DEPARTMENT OF REVENUE TaxColoradogov DONOTSEND Table 1.

. Electric or plug-in hybrid electric vehicle including vans capable of seating 12 passengers or less eg Chevrolet Volt Nissan Leaf Mercedes-. The Colorado Innovative Motor Vehicle Credit is entered on line 22 of your Colorado Form 104 and is subtracted from line 15 your net Colorado income tax. At up to 6000 Colorado bets BIG.

If you purchase a new electric vehicle by the end of 2020 you can get a 4000 tax credit. 1750 for lease Medium-duty electric truck 5000 for purchase or conversion. The current iteration offering up to 5000 in tax credits dropped to 4000 in January and will be reduced again to 2500 next year.

If you purchase a new electric vehicle from 2021-2023 you can get a 2500 tax credit. Colorados alternative-fuel vehicle tax credit is one of the most lucrative in the nation. Chevy Bolt Chevy Bolt EUV Tesla Model 3 Kia Niro EV Nissan LEAF Hyundai Kona EV Audi e-tron Rivian R1T Porsche.

The new formula is very simple for calculating the credit. Contact the Colorado Department of Revenue at 3032387378. 25 up to 6000 Clean fuel refrigerated trailer.

If your total subtractions lines 16-23 exceed your net CO income tax you will be refunded. If you lease an electric vehicle for two years beginning before the end of 2020 you can get a 2500 tax credit. Line 16 Calculate your tentative tax credit take the.

Colorados tax credits for EV purchases. 2 hours agoThe top five public companies in Colorado ranked by 2020 revenue mostly saw their market cap decrease with one exception last. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

1500 for lease Light-duty electric truck 3500 for purchase or conversion. Amount on line 14 multiplied by line 15. The tax credit for most innovative fuel.

2021-2022 2023-2025 Light-duty EV 2500 for purchase or conversion. Medium duty electric truck. HB 13-1247 restructured the method for determining electric vehicle tax credits in Colorado but it also extended these credits through the year 2021.

How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. Last year the state legislature extended the income tax credits through the end of 2025 offering 2000 a year between 2023 to 2025. Credit Values for Purchase Lease or Conversion of a Qualifying Motor Vehicle or Truck Select and enter the correct amount from this table on line 9 of the form.

Light duty passenger vehicle. As in you may qualify for up to 7500 in federal tax credit for your electric vehicle. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this.

Line 17 Maximum. Electric-Vehicle Tax Credit Colorado EV Infrastructure. Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles.

Xcel Energy has a new suite of programs to supercharge Colorados switch to electric vehicles. For additional information consult a dealership or this Legislative Council Staff Issue Brief. Tax credits are as follows for vehicles purchased between 2021 and 2026.

Therefore you will receive the benefit of the full 5000. 112020 112021 112026 Classification Gross Vehicle Weight Rating GVWR Light duty passenger vehicle NA 2500 2000 1500. Colorado Likely to Extend 6000 Plug-In Vehicle Tax Credit to 2021.

Tax Year 2021 Instructions DR 0617 071321 COLORADO DEPARTMENT OF REVENUE. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. The most recent application period for Colorado EV incentives ended June 11 2021.

The credit is worth up to 5000 for passenger vehicles and more for trucks. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. 25 up to 6000 Aerodynamic technologies.

So weve got 5500 off a new EV purchase or lease and 3000 off of used. Electric Vehicle Tax Credit For 2021 Sales of 2022 of Electric Vehicles continues go grow. 112017 112020 112021 but prior to.

1500 for lease 2000 for purchase. Heavy duty electric truck. Transfer the allowable credit amount to the appropriate income tax form where requested.

Examples of electric vehicles include. Light duty electric truck. Credit Amounts for Leases of Qualifying Electric and Plug-in Hybrid Electric Vehicles and Trucks Tax year beginning on or after.

1750 for lease 2800 for purchase. Colorado Electric Vehicle Tax Credit. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits.

Colorados electric vehicle tax credits have been extended with a phaseout in place for purchases of electric vehicles in the following years. At first glance this credit may sound like a simple flat rate but that is unfortunately not the case.

Tax Credits City Of Fort Collins

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

Tax Credits Drive Electric Northern Colorado

Colorado Ev Incentives Ev Connect

Rebates And Tax Credits For Electric Vehicle Charging Stations

Pros And Cons Of Buying An Electric Vehicle In 2020 Vs 2021 Aspentimes Com

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Colorado Solar Incentives Colorado Solar Rebates Tax Credits

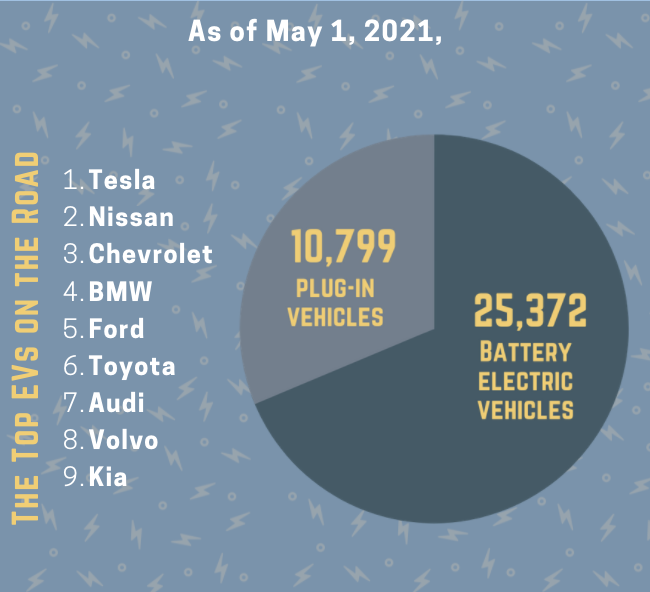

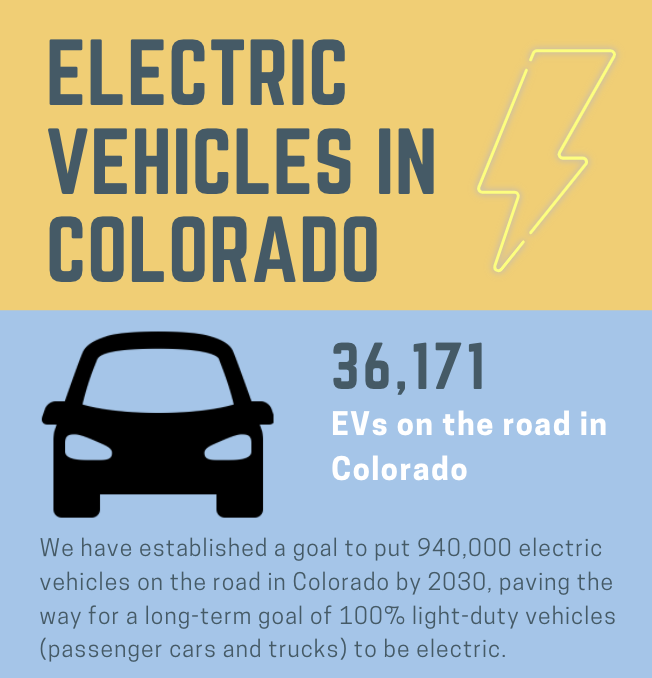

Electric Vehicles In Colorado Report May 2021

Electric Vehicles In Colorado Report May 2021

Evs In Colorado Dashboard Colorado Energy Office

Electric Vehicle License Plate Bill Passes

Zero Emission Vehicle Tax Credits Colorado Energy Office

Federal Tax Credit For Electric Cars In 2021 Atlantic Chevrolet

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra